Is a solar photovoltaic system a good investment?

With rising electricity prices and Eskom loadshedding likely to be part of South African life for the near future, more households are looking to achieve more independence from the national power grid.

As people evaluate their options, one of their most frequent questions is whether investing in a solar installation will increase the value of their home. The short answer is yes, the long answer is it’s complicated.

A photovoltaic (PV) system is composed of one or more solar panels combined with an inverter and other electrical and mechanical hardware that use solar energy to generate electricity.

According to Christiaan Hattingh, managing director of energy solutions provider, AWPower, a solar installation will generally make a home more attractive to buyers in South Africa. However, there is no simple formula to calculate exactly how much value your investment in a PV solution will add to your property.

This will depend on factors such as where your property is located, the type of installation you have put in place and how much the installation enables you to save on your monthly power bill.

“Homeowners should invest in a high-quality installation with a long warranty to ensure it adds to the value of the home,” says Hattingh. “A system made of low-quality components will not add to your property’s value.”

Hattingh says that homeowners should also recognise that a solar PV system, like any other fixture in their home, will need to be maintained over the years to preserve its functionality and add value to your property. “It’s wise to get professional advice to avoid overcapitalising, if increasing the value of your home is a primary consideration,” he adds.

One of the key considerations for homeowners is accessing funding to pay for a solar installation. There are a few specialist financing solutions for residential solar, but most homeowners with an access bond will find that to be their best and easiest option.

“Many of our residential customers have found that their savings on their monthly electricity bill pays for the interest on the money they took from their access bond to pay for their solar system,” says Hattingh. “Your bond will generally be the financing option that offers you the lowest interest rate for your investment in solar.”

Getting the best return on your investment

To optimise your return on investment from solar, you should start with a clear view of what your primary objective is. If you want to simply save money on electricity and add value to your home over the longer term, a grid-tied system solar PV system with PV panels and an inverter is a good place to start. Such a system will cover at least some of your power needs when the sun is shining.

Just how much money you will save on the monthly bill depends on how many solar panels you install on your roof and how much electricity you consume during sun hours. However, your solar power will stop producing during an outage or loadshedding for safety reasons, says Hattingh. Thus, if you want to have power during outages, you should look at a hybrid system with battery backup.

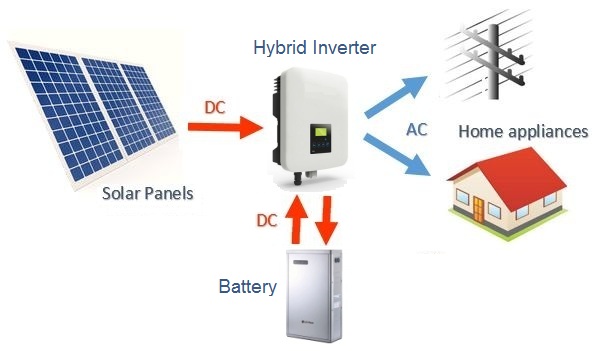

A solar hybrid system includes batteries for storing excess power and a hybrid inverter. With a hybrid system, some essential loads on your property can remain on during loadshedding, while non-essential loads will be turned off. As you add more batteries, you will be able to run more loads during outages, but your capital costs will rise.

“The good news is that solar hybrid systems can be installed in stages to spread out the cost,” says Hattingh. “If your primary goal is to bring down your power bill, you can begin with solar panels and an inverter. You can use the savings to add batteries later. If you want a reliable power supply during outages, you can start with batteries and a hybrid inverter, adding solar panels over time.”

Solar panels will pay for themselves in electricity savings over a number of years. Batteries are a significant capital cost, and the more you install, the slower the payback period will be. AWPower recommends lithium-ion batteries over lead-acid (deep cycle AGM/GEL) batteries. They are more expensive, but last 10 years or more compared with the two-to-three-year lifespan of lead-acid batteries.

Sorry, the comment form is closed at this time.