Higher bond numbers show banks still bullish on real estate

There has been a 4,2% increase in the number of bond approvals over the past 12 months, despite a 2,9% decline in the number of home loan applications.

That’s the word from Rudi Botha, CEO of SA’s biggest bond originator BetterBond, who says: “This speaks very clearly to the increased appetite that banks have been showing for the home loans market – especially in the R500 000 to R1m price category, which currently accounts for 42,5% of loans granted, compared to 38,7% a year ago.

“What is more, our latest statistics* show that the number of bonds formally granted has also risen (by 3,9%) and that the value of those bonds has increased by almost 11%. This not only shows that the take-up rate of the bonds that have been approved is better than it was 12 months ago, but also that the average size of those bonds is bigger.”

Indeed, he notes, the latest Reserve Bank figures show a year-on-year increase of 3,6% in household mortgage balance growth at the end of June (compared to 3,1% in June 2017), while the BetterBond figures show that the average bond granted has risen 7,6% to R941 000 in the year to end-July, and that the average bond granted to first-time buyers has risen 11,3% to R749 000.

Suggested for you:

“At the same time, the average home purchase price has risen 6% to R1,16m, and the average first-time buyer price has risen 9,9% to R838 000, but the average deposits being paid by home buyers have shown almost no change. In other words, the banks are sufficiently enthusiastic about the real estate market at this stage to make up the difference by granting bigger bonds.”

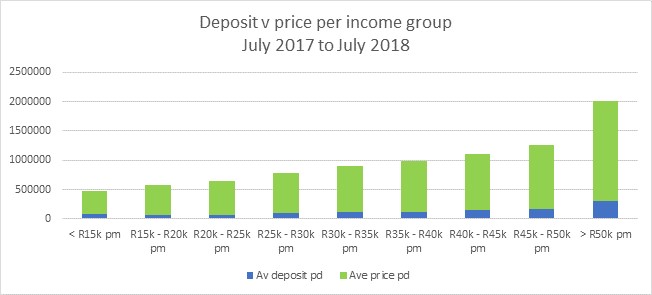

Nevertheless, says Botha, home buyers across the board continue to commit large sums of their own money to their home purchases (see table), which bodes well for the future of the market.

“Paying a deposit is also important for their own financial future, because it will lower their monthly bond repayments and thus make their home more affordable while also providing protection against future interest rate increases and helping them to pay their homes off more quickly.

“Many people don’t know this but paying a deposit also gives home buyers a better chance of having their home loan approved in the first place, and then improves their chances of being able to negotiate a lower interest rate – and save many thousands of rands on the total cost of their home over the 20-year life of their bond.”

However, he says, such rate concessions are certainly not automatically offered, which is why it is always best to apply for a home loan through a reputable bond originator like BetterBond, which will individually motivate each application to multiple lenders and secure the lowest interest rate possible – at no cost to the borrower.

“The effectiveness of this approach is evident from the fact that we are currently able to obtain approval for more than 80% of the bond applications we submit to the lenders.

“In addition, we are currently finding a variance of at least 0,5% between the best and worst rate concessions being offered on the average application submission – which translates into a potential interest saving of almost R120 000 for the borrower with 20-year loan of R1,5m, plus an annual saving of R6000 on their home loan instalments.”

*The BetterBond statistics represent 25% of all residential bonds being registered in the Deeds Office and are thus a reliable indicator of the state of South Africa’s residential property market.

Latest…

General, Lifestyle

Showing off on show day

Although many prospective buyers test the market online these days, most want to physically visit and experience a property before making one of the biggest investment decisions of their lives. This means that show houses are just as important as ever, says Tyson Properties CEO,...

Read MoreGeneral, Lifestyle

An expert guide to purchasing property from a deceased estate

Purchasing a property from a deceased estate is no ordinary property transaction. While there might be a great opportunity to buy a home at an attractive price, it’s essential to understand the complexities involved, including the possibility of prolonged waiting periods, says Andrea Tucker, Director...

Read MoreGeneral, Lifestyle

How financial institutions can assist with easing the burden of bond repayments

Purchasing a home is a significant financial commitment that requires careful planning and long-term dedication. When taking out a bond or mortgage, potential homeowners agree to repay the borrowed amount with interest over a specific period. Managing bond repayments is crucial for maintaining a good...

Read MoreGeneral, Lifestyle

Designing the ultimate backyard entertainment area

Summertime is synonymous with outdoor gatherings, garden parties and the national South African pastime, the ubiquitous braai and creating the ultimate backyard space for these occasions not only enhances your enjoyment of your home, but also its value. “We’re blessed with the perfect climate for outdoor...

Read MoreGeneral, Lifestyle

Experts unpack residential rental challenges

While the demand for residential rentals in South Africa is rising, so is the number of defaulting tenants. The depressed economy, interest rate hikes, and the pandemic’s lingering impact on jobs and income, are contributing to an increasing number of South Africans failing to pay...

Read MoreGeneral, Lifestyle

How load shedding is impacting the property market in South Africa

Load shedding continues to significantly reshape the attitudes of homeowners, and the expectations of buyers and sellers, in the South African property market. This is according to Renier Kriek, Managing Director at Sentinel Homes. “Enjoying one’s home to the greatest extent possible during blackouts and...

Read More

No Comments